Filing your Income Tax Return (ITR) every year is not just a financial routine but also a legal duty for every taxpayer in India. The process of ITR filing ensures that the government has a transparent record of your income, taxes paid, deductions claimed, and investments made throughout the financial year. It also helps you build a strong financial profile which is useful for getting loans, visas, or even starting a business.

Despite its importance, many taxpayers often miss the deadline due to lack of awareness, incomplete documentation, or waiting until the last minute. This is why the due date for filing ITR becomes a crucial aspect of tax compliance, and any extension in deadlines is significant news for millions of individuals and businesses across the country.

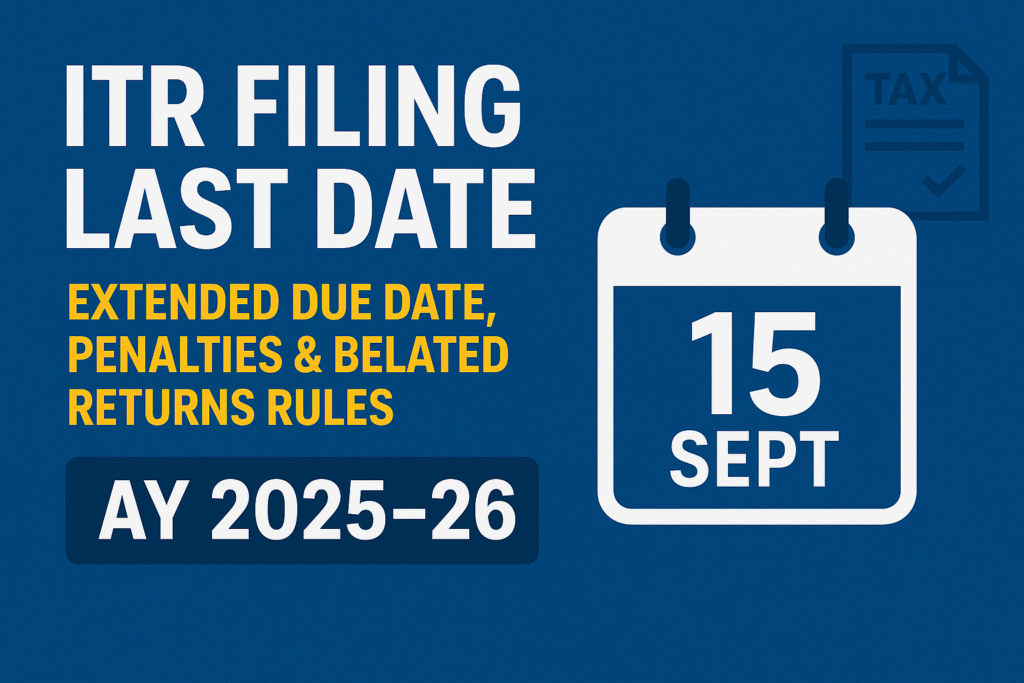

For the Financial Year 2024–25 (Assessment Year 2025–26), the Income Tax Department has officially extended the deadline for filing ITR for non-audit cases. Initially, taxpayers were expected to complete their filing by 31st July 2025, but due to multiple factors such as technical challenges, heavy portal traffic, and delayed availability of financial documents, the Central Board of Direct Taxes (CBDT) decided to provide extra relief. As a result, the new extended due date for ITR filing is 15th September 2025.

This change is particularly beneficial for salaried individuals, pensioners, freelancers, NRIs, and small business owners who require additional time to gather essential paperwork such as Form 16, Form 26AS, Annual Information Statement (AIS), bank statements, and investment proofs before completing their return.

For businesses and professionals whose accounts require auditing, the timeline remains unchanged. The last date for them to file ITR continues to be 31st October 2025, while the final opportunity for belated returns is 31st December 2025. These deadlines highlight that while the government is willing to provide flexibility, there is still a strict framework that taxpayers must adhere to in order to avoid penalties, interest charges, and long-term financial setbacks.

In this detailed article, we will explore everything about the ITR filing last date 2025, the reasons behind the extension, penalties for missing the due date, detailed rules for belated return filing, and the overall impact of late submission on taxpayers. Whether you are an individual, a salaried professional, or a business owner, this comprehensive guide will ensure that you understand every aspect of the filing process for AY 2025–26 and make informed decisions without falling into the trap of last-minute stress.

Extended ITR Filing Due Date for AY 2025–26

The Income Tax Department announces the due date for filing ITR at the beginning of every assessment year, and usually, the timeline is strict to maintain smooth revenue collection. However, in certain years, the government provides an extension depending on the challenges faced by taxpayers. For the Assessment Year 2025–26, the CBDT has officially extended the ITR filing last date for non-audit taxpayers from 31st July 2025 to 15th September 2025.

This extension is not a random decision but rather the result of various factors. One of the most important reasons is the technical load on the e-filing portal, as lakhs of taxpayers rush to submit returns in the last few days. Additionally, salaried employees often receive their Form 16 only towards the end of June, and reconciling it with Form 26AS or AIS takes time. Similarly, small businesses and freelancers need extra time to calculate income from multiple sources, reconcile GST records, and claim deductions properly. Without such an extension, many taxpayers would either miss the deadline or file inaccurate returns, leading to further complications.

The new deadline of 15th September 2025 is therefore a welcome relief, as it provides nearly one and a half months of additional time. This helps taxpayers complete filing with accuracy rather than rushing into errors that could later invite scrutiny or rectification notices from the Income Tax Department. Another advantage of filing within the extended period is that you continue to enjoy the benefits of timely filing, such as faster refund processing, eligibility to carry forward losses, and a clean compliance record.

Who Benefits from the Extended Due Date?

The extension of ITR filing due date mainly benefits individuals, Hindu Undivided Families (HUFs), salaried professionals, pensioners, freelancers, and small business owners who are not required to undergo an audit. This category makes up the majority of taxpayers in India. For them, the pressure of meeting the original 31st July deadline is often overwhelming, especially when banks, employers, and financial institutions delay issuing the required statements.

For example, a salaried employee needs Form 16 from the employer, TDS details from banks, and investment proof validation to file correctly. If even one document is delayed, it becomes impossible to finish the process by July. With the extension until 15th September 2025, such taxpayers can now comfortably gather all required details, verify them, and file without mistakes.

On the other hand, taxpayers whose accounts are subject to a statutory audit, such as companies, LLPs, and professionals with high turnover, are still required to follow the 31st October 2025 deadline. This is because audited cases involve a more complex financial review process and already have a later due date, hence no further extension is granted in their case.

Government’s Reason for Extension

The CBDT has always clarified that extensions are not meant to encourage taxpayers to delay but rather to ensure fairness and accuracy in the compliance process. In recent years, the number of e-filing users has increased drastically, crossing several crores. The load on the system, combined with the need for reconciliation between multiple forms such as AIS, TIS, and Form 26AS, often creates difficulties. By giving an extension, the government ensures that taxpayers have enough time to resolve mismatches, verify pre-filled data, and avoid the errors that commonly arise during rushed filings.

Another major reason is the global digital shift in taxation systems. As India moves towards complete digital compliance, errors in reporting even minor incomes like interest from savings accounts or mutual fund redemptions can trigger notices. This makes it more important for taxpayers to double-check every entry before submitting, and the extended due date supports that process.

Key Dates to Remember for AY 2025–26

To make things absolutely clear, here are the main deadlines that taxpayers must keep in mind for this assessment year:

15th September 2025 – Last date for individuals, salaried employees, pensioners, HUFs, and small businesses not requiring an audit.

31st October 2025 – Last date for businesses, companies, and professionals requiring audit.

31st December 2025 – Final date for filing belated returns with penalty.

By keeping these dates in mind and planning ahead, taxpayers can avoid penalties, late fees, and the stress of last-minute filing.

Penalties After the Due Date

Filing your Income Tax Return (ITR) after the official deadline may seem like a small delay, but under Indian tax laws, it comes with significant financial consequences. The government has created a system of penalties and interest charges to ensure taxpayers remain compliant and to discourage delays in filing. For the Assessment Year 2025–26, even though the due date for non-audit taxpayers has been extended to 15th September 2025, missing this deadline will still attract penalties under the Income Tax Act. Understanding these penalties in detail is essential so that you can assess the risks of late filing and avoid unnecessary expenses.

The penalties are not limited to just monetary fines. They can also affect your financial credibility, delay your refunds, and block certain tax benefits like carrying forward losses. By learning how each type of penalty works—whether it is the flat late fee under Section 234F, the monthly interest charges under Section 234A, or the indirect disadvantages—you will clearly see why filing within the due date is always the smarter option.

Late Filing Fee – Section 234F

The most direct penalty for missing the ITR deadline is the late filing fee imposed under Section 234F of the Income Tax Act. This fee is mandatory, meaning that it applies to every taxpayer who files after the due date, regardless of whether or not they actually owe tax.

If your total annual income is more than ₹5 lakh, the late fee is ₹5,000. On the other hand, if your income is less than or equal to ₹5 lakh, the penalty is limited to ₹1,000. Even individuals with no tax liability or those expecting a refund cannot escape this fee once they file after the deadline.

This structure is designed to ensure fairness—taxpayers with higher incomes are charged more because they are expected to comply more strictly. However, for low-income taxpayers, the fee is capped at a smaller amount to reduce the burden. Still, this amount can feel like an unnecessary expense, especially when it could have been avoided simply by filing on time.

Interest on Unpaid Taxes – Section 234A

Apart from the flat late fee, taxpayers who miss the due date and also have outstanding tax dues face an additional cost in the form of interest charges under Section 234A. This section states that any unpaid tax amount will attract 1% interest per month or part of the month starting from the original due date until the actual date of payment.

For example, if you had an outstanding tax liability of ₹30,000 and you filed your ITR three months late, you would have to pay an additional ₹900 (₹30,000 × 1% × 3 months) as interest, apart from the late fee under Section 234F. Importantly, this interest is charged on the entire unpaid amount, and even a small delay of a few days counts as a full month under this rule.

This interest can accumulate quickly and add to the overall tax burden, making it much more costly than filing on time. For individuals with high incomes or significant pending dues, the financial loss from interest can become substantial.

Loss of Carry Forward Benefits

One of the less obvious but very serious penalties for missing the ITR deadline is the loss of the ability to carry forward certain losses to future years. Under tax laws, taxpayers can normally carry forward losses from sources such as business, capital gains, or speculation to set them off against future income, thereby reducing tax liability in later years.

However, if you miss the due date and file a belated return, you lose the right to carry forward most of these losses. The only exception is house property loss, which can still be carried forward even with a belated return. This restriction can have a long-term impact on your financial planning because once the deadline is missed, the tax-saving opportunity for that year is permanently lost.

For example, if you incur a ₹2 lakh capital loss on shares in FY 2024–25 and fail to file your ITR by the due date, you will not be allowed to use this loss to offset capital gains in future years. This can increase your tax liability significantly when you make profits in the following years.

Delay in Refund Processing

Another indirect penalty of filing late is the delay in receiving refunds. Taxpayers who file their ITR on time are usually given priority when it comes to refund processing by the Income Tax Department. Belated returns, on the other hand, are pushed down in the queue and may take several weeks or even months longer to be processed.

This delay can affect your financial planning, especially if you were depending on the refund for making investments, repaying loans, or meeting other expenses. While you may still receive the refund eventually, the late filing essentially blocks your money for an extended period of time.

Higher Scrutiny from the Tax Department

Filing after the deadline can also increase the chances of your return being scrutinized by the Income Tax Department. While not all late returns are investigated, taxpayers who miss deadlines are often considered higher risk because late filing may suggest carelessness, hidden income, or incomplete disclosures.

This could result in notices, demands for additional documentation, or in extreme cases, audits. Even if your return is genuine and accurate, the extra scrutiny can cause stress, wasted time, and additional compliance costs.

Impact on Financial Credibility

Your ITR is not just about taxes—it is also a financial record that acts as proof of income for various purposes. Banks, non-banking financial companies (NBFCs), and even foreign embassies often request copies of recent ITRs when processing loan applications, credit card approvals, or visa requests.

Filing late or missing deadlines frequently may give the impression that you are financially undisciplined, which can negatively affect your chances of getting a loan approved or your visa application processed smoothly. For instance, if you plan to study abroad or apply for a home loan, not having timely ITR records may delay or even block your approval.

Key Takeaway on Penalties

The penalty system under the Income Tax Act is structured to encourage timely filing by making delays costly both financially and practically. While the ₹1,000 to ₹5,000 late fee under Section 234F may not seem very high, when combined with monthly interest under Section 234A, loss of carry forward benefits, refund delays, and potential scrutiny, the overall consequences can be quite severe.

Therefore, taxpayers should treat the extended deadline of 15th September 2025 as the final opportunity to file on time without incurring penalties. Filing earlier within this window is even better, as it ensures faster refund processing and reduces the chances of last-minute stress or technical issues on the portal.

Belated Return Rules: Everything You Need to Know for AY 2025–26

Even after the Income Tax Department extends the due date, many taxpayers still fail to file their Income Tax Return (ITR) within the permitted window. For such cases, the law provides another opportunity in the form of belated returns. A belated return is essentially a tax return filed after the official deadline but before the end of the assessment year. While it allows taxpayers to comply with legal requirements even after missing the due date, it comes with certain penalties, interest, and restrictions. For the Assessment Year 2025–26, the final date to file a belated return is 31st December 2025.

Belated return rules are particularly important for taxpayers who miss the 15th September deadline (for non-audit individuals) or the 31st October deadline (for audit cases). Instead of skipping filing altogether—which could lead to notices and non-compliance—the option of belated filing ensures that income is still reported, tax dues are settled, and the taxpayer remains within the legal framework.

What is a Belated Return?

A belated return refers to filing your ITR after the original due date has expired. For the financial year 2024–25 (AY 2025–26), if an individual or business fails to file by 15th September 2025 (non-audit cases) or 31st October 2025 (audit cases), they still have the chance to file up to 31st December 2025. After this final date, the portal will not accept returns unless the taxpayer falls under very specific exceptions provided by the Income Tax Department.

The main idea behind a belated return is that late filing is still better than non-filing. Even though penalties apply, the taxpayer remains compliant and avoids the bigger risks of concealment,prosecution, or departmental scrutiny for non-reporting of income.

Penalty Under Section 234F

When a taxpayer files a belated return, a late filing fee under Section 234F is mandatory. The penalty depends on the total income of the taxpayer:

If the total income is above ₹5 lakh, the late filing fee is ₹5,000.

If the total income is up to ₹5 lakh, the late fee is reduced to ₹1,000.

This penalty is charged regardless of whether you have tax dues or are expecting a refund. For example, even if you are due to receive a refund of ₹15,000, you must still pay ₹5,000 or ₹1,000 as the late fee before your belated return can be processed.

Interest on Unpaid Taxes – Section 234A

Apart from the penalty fee, taxpayers filing belated returns also need to pay interest on any unpaid taxes under Section 234A. This interest is calculated at 1% per month or part of a month from the original due date until the date of actual filing.To illustrate, suppose you had an outstanding tax liability of ₹40,000 as of 15th September 2025 and you file your ITR on 15th December 2025. In that case, you would pay interest for three full months at the rate of 1%, which comes to ₹1,200, in addition to the penalty under Section 234F. This interest is unavoidable once the due date is missed.

Restrictions on Belated Returns

Belated returns are legally valid, but they come with several restrictions that reduce their overall benefits compared to timely returns. Some of the most important limitations are:

No Carry Forward of Certain Losses: Taxpayers filing belated returns cannot carry forward losses such as business loss, speculative loss, or capital loss to future years. The only exception is house property loss, which can still be carried forward. This can significantly affect long-term tax planning for businesses and investors.

Refund Delays: Belated returns are processed only after timely returns are cleared, which means refund processing is usually delayed. Taxpayers expecting a refund may have to wait longer compared to those who filed on time.

Revision Limitation: A belated return can be revised, but only up to 31st December 2025 or until the assessment is completed, whichever is earlier. This shortens the time window for corrections compared to timely filed returns.

Higher Scrutiny Risks: Late filing may raise red flags with the Income Tax Department, leading to higher chances of notices or queries.

Why Filing a Belated Return is Still Better Than Non-Filing

Even with penalties and restrictions, filing a belated return is always better than not filing at all. A belated ITR ensures that your income is reported, taxes are paid, and compliance status is maintained. Non-filing, on the other hand, can result in far more serious consequences such as prosecution, heavy fines, or blacklisting by financial institutions.

Additionally, belated returns still serve as valid proof of income, which is often required when applying for loans, credit cards, or visas. For instance, if you are applying for a home loan in early 2026, lenders will request your ITR for the previous year. Even a belated return will work as proof, whereas having no return at all could block your loan application entirely.

Important Dates for Belated Return Filing in AY 2025–26

15th September 2025 – Extended due date for individuals and non-audit taxpayers.

31st October 2025 – Due date for businesses and professionals requiring audit.

31st December 2025 – Final deadline for filing belated returns with penalty.

Taxpayers should treat 31st December 2025 as the absolute last opportunity. Once this date passes, there is no option left for filing unless the government announces special relief under extraordinary circumstances.

Broader Impact of Missing the ITR Filing Deadline for AY 2025–26

Filing Income Tax Returns (ITR) on time is not only a legal responsibility but also a financial habit that carries long-term benefits. When taxpayers miss the official deadline—whether it is 15th September 2025 for individuals or 31st October 2025 for audit cases—they face more than just late fees and penalties. The consequences of delayed filing extend into multiple aspects of financial life, including loan applications, visa processing, refund delays, and overall financial credibility. For this reason, missing the ITR deadline should be considered more than just a technical lapse—it can potentially impact a taxpayer’s financial reputation and opportunities.

Impact on Refund Processing

One of the most direct consequences of missing the deadline is delayed refund processing. When returns are filed on time, the Income Tax Department prioritizes them for processing. However, belated returns or very late filings are usually kept in the second cycle, which means taxpayers must wait longer to receive refunds.

For example, a salaried individual who had excess TDS deducted may be eligible for a refund of ₹25,000. If the return was filed by September 2025, the refund could be credited within a few weeks or months. But if the return is filed as a belated one in December 2025, the refund might not be processed until mid-2026. This delay can create liquidity problems, especially for taxpayers who rely on refunds to manage household or business expenses.

Difficulties in Loan Approvals

Another major impact of missing the ITR deadline is related to loan applications. Banks and financial institutions require ITR documents as proof of income and repayment capacity. When a taxpayer fails to file on time, it raises doubts about their financial discipline. Even if a belated return is filed, some lenders consider it less reliable than a timely filed return.

For instance, when applying for a home loan, banks often ask for ITRs of the last three years. If the most recent year shows a delayed filing, the bank may either delay the loan approval or demand additional documents such as salary slips, Form 16, or audited statements. In some cases, the loan may be sanctioned at a higher interest rate due to perceived risk. This shows that a late return not only attracts penalties but can also increase the cost of borrowing.

Visa and Immigration Challenges

In addition to banks, embassies and immigration authorities frequently request ITRs during visa applications, especially for countries such as the United States, Canada, the UK, and European nations. A late-filed return is still considered valid, but visa officers may interpret delayed compliance as a sign of weak financial management.

For example, an individual applying for a student visa or work permit may be asked to submit ITRs as proof of financial stability. If the ITR is missing or filed very late, the visa processing officer may demand alternative financial documents or question the applicant’s credibility. This can delay visa approvals or, in some cases, reduce the chances of success. Timely returns therefore serve as a financial reputation certificate in global matters.

Loss of Carry Forward Benefits

As already explained in the context of belated returns, one of the most significant impacts of missing the deadline is the loss of carry-forward of certain losses. This particularly affects taxpayers who actively trade in the stock market, invest in mutual funds, or run businesses that may have incurred losses in a given year.

For example, if an investor incurred a short-term capital loss of ₹1,50,000 during FY 2024–25, timely filing would have allowed this loss to be carried forward for up to 8 years. It could then be set off against future capital gains, reducing tax liabilities. However, if the return is filed late, this benefit is permanently lost, forcing the taxpayer to pay higher taxes in subsequent years. Thus, missing the deadline directly impacts long-term wealth creation strategies.

Higher Chances of Scrutiny

Another indirect impact of missing the deadline is the increased chance of scrutiny from the Income Tax Department. The tax authorities often use filing patterns to determine which taxpayers should be examined more closely. Late filing can trigger red flags, especially if the taxpayer has high-value transactions such as large bank deposits, property purchases, or foreign investments.

Once flagged, the taxpayer may receive notices requiring detailed explanations of income sources, tax deductions, and financial transactions. Even if everything is legitimate, responding to such notices can be time-consuming, stressful, and costly if professional help is required. Filing on time significantly reduces the likelihood of such scrutiny.

Impact on Business Reputation

For businesses and professionals, late filing can hurt credibility with clients, vendors, and investors. Many contracts and tenders require submission of recent ITRs as proof of compliance. A business that consistently files late may be perceived as financially unstable or poorly managed. This perception can result in loss of contracts or missed business opportunities.

For example, if a contractor wishes to bid for a government project in early 2026, the tender document may require ITR acknowledgments for AY 2025–26. A missing or delayed return could disqualify the contractor from the bidding process. In this way, filing delays directly affect growth and expansion opportunities.

Psychological and Administrative Burden

Beyond financial penalties, missing the deadline also creates a psychological and administrative burden. Taxpayers who delay filing often experience stress due to accumulating penalties, interest, and notices. The act of catching up later usually requires additional documents, explanations, and coordination with employers, banks, or auditors. This makes the process more complex than filing on time.

Moreover, once a taxpayer falls behind, the habit of timely compliance can weaken, creating a cycle of repeated delays. Over time, this erodes financial discipline and increases exposure to legal risks. Timely filing, on the other hand, provides peace of mind and a sense of financial control.

The Ripple Effect of Non-Compliance

The impact of missing the ITR deadline extends beyond a single year. It creates a ripple effect that influences multiple financial activities in the future. Higher borrowing costs, reduced investment opportunities, delays in refunds, and increased scrutiny together weaken a taxpayer’s overall financial standing.

In other words, while the penalties and interest charges are immediate and visible, the hidden costs of delayed filing often turn out to be much higher in the long run. This is why financial planners strongly recommend timely filing not just as a tax-saving measure but also as a cornerstone of financial health.

Impact of Timely ITR Filing on Financial Planning

Filing your Income Tax Return (ITR) on time is not just about avoiding penalties; it also plays a major role in building a disciplined financial life. When you file before the deadline, you get a clear view of your annual income, expenses, investments, and tax liabilities. This information becomes a base for planning your future savings, making smart investments, and securing financial stability. For example, if you know how much tax you saved through Section 80C investments, you can plan better for the next year by choosing ELSS, PPF, or insurance policies that give both returns and tax benefits.

Timely ITR filing also improves your financial credibility. Banks and financial institutions often check ITR copies before approving loans or credit cards. A record of consistent ITR filing helps you build trust and increases the chance of loan approvals at better interest rates. Similarly, embassies of countries like the US, UK, and Canada ask for ITR receipts during visa applications to confirm stable income. By filing on time, you create a strong track record that supports your personal and professional growth.

From a long-term perspective, regular and punctual ITR filing ensures that you never miss out on tax refunds. Refunds are usually processed faster when returns are filed early, which improves your cash flow. This extra money can be reinvested or used for personal needs, reducing dependency on loans or credit. Hence, filing on time is not just a legal obligation but also a smart financial strategy.

Common Mistakes to Avoid While Filing ITR

Many taxpayers face issues not because they want to delay but because of mistakes during the filing process. One common error is selecting the wrong ITR form. The Income Tax Department has different forms for salaried individuals, self-employed persons, and businesses. Filing in the wrong form can lead to rejection or notices. Another mistake is mismatching information with Form 26AS or AIS (Annual Information Statement). If the details of TDS, salary, or bank interest do not match, it creates discrepancies and may lead to scrutiny.

Another frequent issue is forgetting to report additional income. Many people only show salary income but forget to include income from savings account interest, freelance earnings, or rental income. Hiding such details, even by mistake, can lead to penalties or notices later. Similarly, errors in claiming deductions under sections like 80C, 80D, or HRA exemption also create problems. Claiming false deductions or entering wrong figures may delay processing or even attract penalties.

Technical mistakes such as failing to verify the return after filing also make the ITR invalid. The Income Tax Department requires e-verification through Aadhaar OTP, net banking, or by sending a signed ITR-V form to CPC Bangalore. Without this step, your return is treated as not filed. By avoiding these common mistakes and double-checking every detail before submission, taxpayers can ensure a smooth filing experience and avoid unnecessary trouble.

Expert Tips for Stress-Free ITR Filing

To make the ITR filing process simple and stress-free, preparation is the key. Start by collecting all necessary documents such as Form 16, Form 26AS, AIS, bank statements, and proof of tax-saving investments well before the due date. Having these records ready ensures accurate data entry and reduces the risk of errors.

Another useful tip is to use reliable ITR filing platforms or professional help if your income sources are complex. While salaried employees may find online filing easy, business owners or freelancers with multiple incomes often benefit from consulting a tax expert. This not only saves time but also ensures compliance with the latest tax rules.

Always aim to file early, at least a few weeks before the deadline. The closer you get to the due date, the heavier the traffic on the e-filing portal, which may lead to technical issues. Early filing also ensures quicker refunds and gives you time to revise in case of any mistakes.

Finally, keep track of all communications from the Income Tax Department. Notices, emails, or SMS alerts regarding your ITR should not be ignored. Responding promptly prevents bigger issues later. With proper planning, use of digital tools, and attention to detail, filing your ITR can become a smooth annual routine rather than a stressful last-minute task.

Conclusion

Filing your Income Tax Return (ITR) is more than just a legal duty; it is an important step in building financial discipline and securing long-term benefits. For the financial year 2024–25 (Assessment Year 2025–26), the government has extended the ITR filing due date to 15th September 2025 for individuals and non-audit taxpayers, while businesses that require audit have until 31st October 2025. Even after these deadlines, taxpayers have the option of filing a belated return up to 31st December 2025, though penalties and interest will apply.

Missing the ITR deadline can lead to late fees under Section 234F, additional interest under Section 234A, and the loss of valuable benefits such as carrying forward business or capital losses. More importantly, it can delay refunds and affect financial credibility, especially when applying for loans, credit cards, or visas. On the other hand, filing on time helps build a strong financial profile, ensures faster refunds, and provides peace of mind by avoiding last-minute stress.

The best way to handle ITR filing is to stay informed, prepare documents in advance, avoid common mistakes, and use expert help whenever necessary. Filing early not only reduces errors but also improves your chances of hassle-free processing and timely refunds. With proper planning and awareness of deadlines, taxpayers can easily meet their obligations without facing penalties or complications.

In short, timely ITR filing is not just about compliance—it is about financial security, credibility, and growth. By respecting the due dates and staying disciplined, you can turn the annual filing process into a smooth and beneficial part of your financial journey.

Disclaimer:

This article is for informational purposes only and does not replace professional tax advice. Please consult a qualified tax expert or chartered accountant for guidance specific to your situation. The author is not responsible for any decisions or actions taken based on this information.